Why Using Multiple Business Entities May Help Your Business

One of the most popular ways to protect businesses from potential legal liability is to use multiple business incorporations. This typically entails a business putting assets in different LLC’s or corporations. The biggest benefit to business owners is that if you have a big mess up, or financial loss, in one part of your business it doesn’t have to impact all of your assets.

How Multiple Business Entity Strategies Work

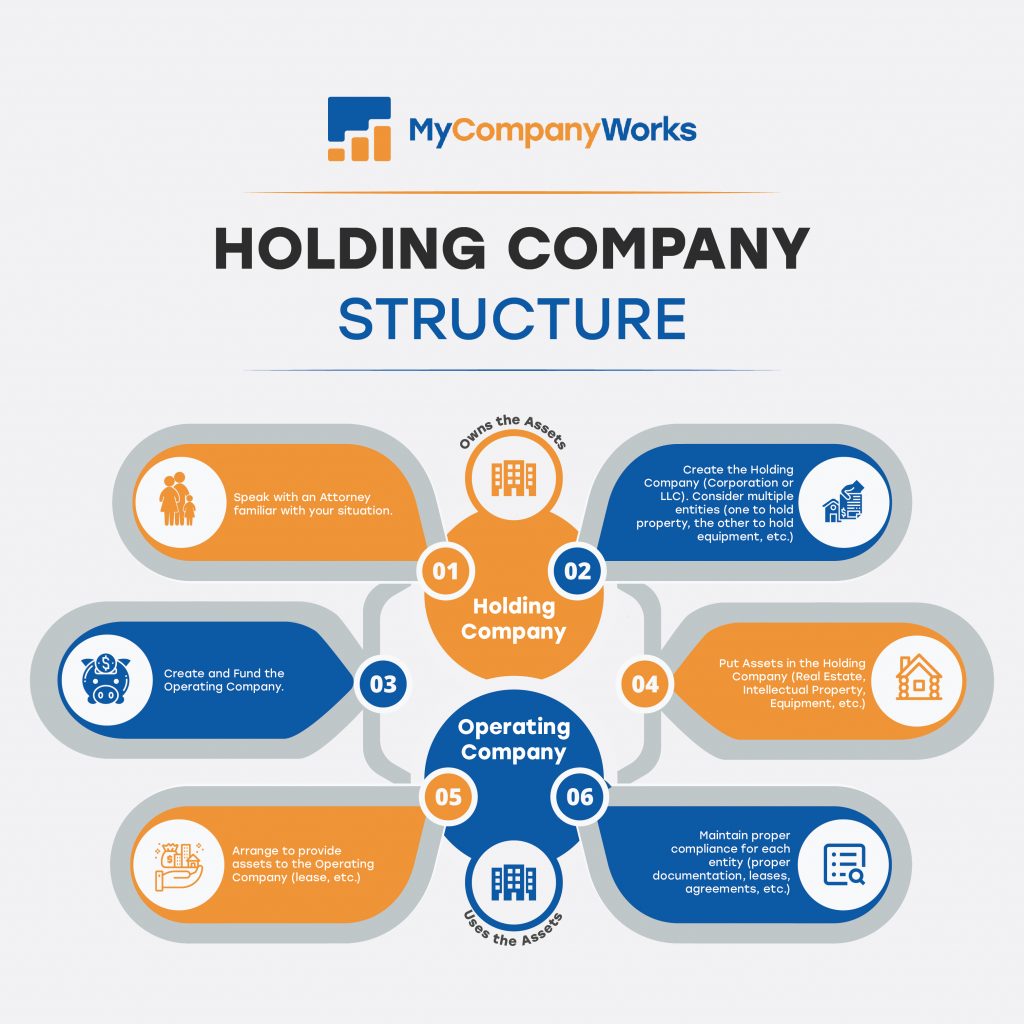

A multiple business entity strategy typically includes two different types of entities. The first is an operating company and the second is a holding company. The operating company as access to, and typically possession of, the assets but doesn’t have ownership of them. The holding company owns the assets but does nothing else.

This is beneficial because if the operating company takes on legal liability during the course of their operations, it is very difficult for anyone to get access to the assets the holding company owns. So the business can continue to operate after surviving a lawsuit since the assets are protected because the operating company takes all the risk.

For example, retailers use this multiple business entity strategy on a per location basis. This is often done by retailers to protect each physical location as its own business, with its own assets. So if one location has a massive slip and fall lawsuit, the results are limited to an impact on that individual entity.

It’s important to make sure that your holding company doesn’t actually do any business outside of creating and funding any needed operating companies. If the holding company starts doing day to day operation activities then the corporate veil can be pierced, causing the holding company to be liable for many wrongdoings.

If the operating company needs to purchase additional assets after operations have begun, the holding company can act as a lender in order to fund the activity. This should be done with a lien that runs back to the holding company to show the loan, and paid back in the same manner any other business loan would be. This is done so that it doesn’t look like the holding company is responsible for operating activities.

How to Create a Multiple Business Entity Strategy

The first thing you need to do is to create a holding company. This can be an LLC or a corporation (but not an S-Corporation which is not able to own or be owned by other entities), depending on your personal situation. After consulting with your attorney and/or accountant, you should create and fund your holding company. We recommend using an industry expert to get your business incorporated.

Once the holding company is created then that company should create and fund the operating company, as needed. This way the operating company is directly owned by the holding company so that the holding company can maintain the most important assets.

This also gives the business owner the added personal protection from any potential debts the business way accumulate. With the holding company funding the operating company, there won’t be any personal guarantees on any debt that is required. This is a huge benefit to owners looking to create and fund businesses without wanting to personally take on debt.

A Common Legal Mistake With Multiple Businesses

One common mistake that many businesses make is that they only consider the tax consequences of how to set up their businesses. There can be a nice tax advantage in creating a single LLC and then registering different DBA’s (doing business as) instead of creating a unique legal entity for each one. The problem with this is that you don’t get the same legal protections so if one struggles then you could be risking the assets of all the others.

Assets the Holding Company Should Own

The most basic answer to the question on what assets the holding company should own is that it should own all of the important ones. If you have something you don’t want to lose if everything were to go wrong, then those things should be owned by the holding company. Below is a list of things that you should consider the ownership for.

- Real Estate – Office buildings, investment properties, or land.

- Proprietary Software – Software you currently sell, or would like to in the future.

- Patents – Patents for any product you’ve established can be leased to the operating company.

- Websites – If the websites are vital to the process or existence of your operating business.

- Trade Secrets – Anything that may give your business a competitive advantage and be considered an asset.

- Trademarks – You don’t want to have to rebrand your business if your operating company loses the ownership rights to a valuable name.

- Any asset that doesn’t have to be owned by the operating company

Thinking about the legal structure when you’re setting up the company assets could save you a lot of unnecessary headaches later. The key thing to remember is that even if the operating company needs an asset in their day-to-day work, it doesn’t mean that entity has to own it. you can always set up the holding company on a consulting or leasing basis to provide the other entities for what is needed.

Who Should Use a Multiple Business Entity Strategy

A multiple business strategy is typically right for entrepreneurs or businesses with assets from multiple operations. While this isn’t an all-inclusive list, there are a few specific types of situations that will find this strategy to be helpful. Those who should consider using a multiple business entity strategy include:

- Serial Entrepreneurs: Chances are if you like to start businesses pretty regularly then you’ll have a holding company to house your ownership in each of the businesses. As a serial entrepreneur, most of your businesses likely won’t have anything to do with one another so it wouldn’t make much sense to house them all together. This strategy is a natural fit with this situation.

- Businesses That Own Real Estate: Regardless of what your core operation might be, owning real estate is a nice way asset to have to secure the future of your business. If something were to go wrong, you wouldn’t want to lose the real estate that has grown in value since you purchased it. Instead, keeping the asset in a holding company and leasing back necessary space to the operating company is a much safer strategy to protect your real estate as the value continues to increase.

- Businesses Selling a Proprietary Asset: Many businesses are only operating in order to sell something that they’ve created. These days, that routinely means a piece of software that they’ve developed. Keeping the ownership of the software, or other asset, in the holding company instead of the operating company can mean better overall protection and decision making since you know that your most important asset isn’t at risk. Sadly, many businesses have lost those assets during rough times because it was the only asset the operating company could monetize to pay off creditors.

- Businesses Wanting to Start a New Product or Service: Sometimes businesses decide that their customers have a need that isn’t being met by anyone else. This can result in a new product or service offering. For example, a software company that decides they can adequately consult with the same customers they currently target. These businesses should separate the two operations, as they are different businesses. This is a good operational strategy and a good legal strategy.

These are the most common instances where you’d want to use this multiple business entity strategy, however there are more. You should consult with a lawyer to know how your legal setup will impact your business strategy going forward.

Multiple Business Entity Frequently Asked Questions (FAQs)

The multiple business entity strategy can be complicated but if you’re planning on owning multiple types of assets or businesses then it is a vital one to adopt. We’ve put together a few of the most common questions to help you better understand the process so that you can better use it to protect your assets.

What’s the primary purpose of a multiple business entity strategy?

Asset protection. If you own assets then you want to have a holding company that has no liabilities other than to you personally, and that has no direct interaction with customers of your operating company.

How many LLCs are too many?

There isn’t a limit to this legally, but you should use as many as you can operationally and financially manage. We’ve seen retail businesses use an LLC for every single one of their hundreds of locations because that’s what makes the most since for them.

Can I use this strategy to protect my personal assets?

Kind of. You can use something very similarly personally where you put your personal assets into LLC businesses to protect yourself, but this strategy is designed to protect business assets more than personal ones.

How does my operating company get access to needed assets in my holding company?

The holding company can lease assets to the operating company so that proper access to run the business is established. For example, if your holding company owns your office building then the operating company can rent out the space.

Getting Started

Now that you can see how important it is to protect your assets from any potential liabilities, you can start the process today by either starting your LLC or corporation from scratch or by adding a second entity to make the strategy work. Either way, you should use a business you can trust to get these set up. Use the source tens of thousands of other businesses have used and follow our simple three step process today.

Need direction on multiple entity structures

Hi, please contact [email protected] – this is the blog comment section.