Top 5 FAQs: How to Sell Books on Amazon With Action Plan

Whether you’re publishing or just reselling, there’s a lot of money to be made with Amazon book sales. This guide covers how to sell books on Amazon, the most frequently asked questions, pitfalls to avoid, and how to get paid as a Limited Liability Company (LLC). Read on to find out how to list books and ebooks on Amazon.

Top 5 Amazon Book Sales FAQs

1. How much can you make selling books on Amazon?

Depending on your book subject and motivation, you can actually make a lot of money selling books on Amazon. According to Amazon’s site, nearly 60% of multichannel sellers named Amazon as their fastest-growing channel. The online retail giant reports that global ebook sales exceed $28 billion dollars each year. Doing some research can help you set pricing, and you can calculate profits in FAQ #2 below.

Kindle publishers are paid either a 35% or 70% royalty for each book sold. Amazon takes 65% on books that sell below $2.99 and above $9.99. They keep 30% on books that sell between $2.99 and $9.99, so you make more money per book in this price range. How much you can make selling books really depends on the demand for your content and effective listings. Amazon has a great guide on how to post the best book listings to increase sales.

Learn more about Kindle royalties

2. How much does it cost to sell books on Amazon?

Amazon fees are separated into 4 categories: Subscription fees, Selling fees, Shipping fees, and FBA fees. Here are the fees for each category.

Subscription fees

If you’re going to sell 40 items or more each month, you can save some money by subscribing to the Professional plan. For $39.99 a month, you can list and sell unlimited items.

Selling fees

Per-item fees: $.99. As we mentioned under Subscription fees, you’ll save money with the Professional selling plan if you plan to sell at least 40 items each month.

Referral fees

All booksellers are charged a 15% referral fee and $1.80 closing fee for each book sold. If you’re selling Collectible books, you’ll be charged a flat fee of 15% per sale.

Shipping fees

Shipping fees depend on whether you’ll fulfill your orders or have Amazon fulfill them for you. Booksellers on the Professional plan can set shipping rates for books (and other media). Simply set custom rates in your Seller Central portal. Individual sellers don’t have the same flexibility. You can check real-time shipping fees in Amazon’s Media Shipping Rates table.

FBA fees

FBA, or Fulfillment by Amazon is very popular for book distribution. If you decide to let Amazon ship your books, you can expect to pay monthly storage fees, and may also have to pay for long-term storage and inventory removal if you stop selling through FBA. Depending on the weight and dimensions of your book, you can anticipate paying anywhere from a few dollars to over $7 per book. You can get exact fulfillment fees from Amazon Seller Central.

Additional selling fees

If you have a lot of active listings that haven’t sold in the last year, Amazon charges a monthly fee of $.005 per listing to cover their cataloging costs. The threshold is 100,000 listings before additional listing fees kick in, so most booksellers shouldn’t have to pay this fee.

A refund administration fee is collected from refunded orders. The cost is either 20% of the referral fee, or $5.00, whichever is less.

Resources for Amazon Sellers

Amazon Business Ideas | How to Sell as a Non-US Citizen | Sell Handcrafted Goods

3. How do I put my book on Amazon for sale?

If you’re reselling books, it’s pretty simple to set up a Seller Central account and start listing products. You may have to go through a few extra steps if you’re publishing a book, but it’s still easy enough to get published and start selling quickly.

Required information for an Amazon Seller Central account

- Either an existing Amazon customer account or a business email address

- Credit card that can be charged internationally

- Current Government-issued identification

- Tax ID – either a social security number or EIN

- Active phone number

- Bank account to receive payments

4. How to make an ebook and sell it on Amazon

Kindle Direct Publishing (KDP) is Amazon’s ebook division. They host a comprehensive help portal to help you format, create, and market digital books fast. Once you’re ready to publish, KDP will walk you through writing a great title, adding authors and contributors, writing an effective book description, and listing in the best categories. You can even set up a pre-order form to promote future ebooks (not available for printed books).

Read more about Kindle Direct Publishing Guidelines

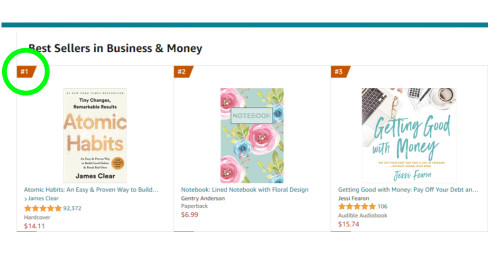

5. How to get a best-selling book on Amazon

A book doesn’t have to make the bestseller list to be successful. But it can help increase sales. Becoming a bestseller is a bit complex, but if you have the right content, optimized listings, and start selling quickly, Amazon’s algorithm will reward your book with more exposure in search results. The process involves various factors.

Top Amazon bestselling factors:

- Book categories and keyword phrases (not individual keywords)

- Current top-selling books in your category

- Your book’s sales the first week it’s listed

- Other books and pricing on promotion lists

It does take some effort to make the list, but you only have to rank #1 in a single category to have your book branded with the best-selling badge.

Selling Books as a Sole Proprietor

You can sell as an individual (called a Sole Proprietor), but you will be required to use your personal information with Amazon and suppliers if you’re reselling books. Your social security number and other personal information can be exposed, which can lead to identity theft and other issues. Filing tax returns can also get tricky if you don’t have a business to separate personal assets from book sales.

The easiest way to protect your identity and separate your assets is to form a company. There are a few options, but the most popular business structure for small businesses is the Limited Liability Company (LLC). An LLC is a separate entity from its owner(s). It can have its own tax ID number (called an Employer ID Number, or EIN) which means you don’t have to use personal information on Amazon.

How to Sell Books on Amazon as an LLC

When you start an LLC for Amazon sales, you’re separating your business and protecting personal assets from potential legal or tax issues. No one wants to be sued while doing business, but it happens. A Limited Liability Company can prevent you from losing personal savings and possessions in the event of a lawsuit.

It’s also easier to buy wholesale books with a registered company. Many suppliers will only sell to businesses, so having an LLC legitimizes your book company. The ability to buy wholesale can increase your profit margins dramatically, which could easier cover the cost of forming an LLC. By the way, LLC formation costs are tax-deductible.

After you form your company, you can sign up with Amazon Seller Central as a business. Simply sign up with your business name, address, and EIN to get paid as a business. If you have signed up as an individual, you can update your account once your company is formed.

Amazon LLC Action Plan

Forming an LLC is pretty straightforward if you’re organized and have all the information you’ll need. Here’s a list of to-do’s to help you start your company.

1. Pick a unique name

With so many people selling books on Amazon, you’ll want to craft a name to make your business stand out. Think of 2-3 words or a short phrase that describes your business. Something like Anna’s Amazon Books or Books to Live By is catchy and memorable for repeat sales.

2. Form a Limited Liability Company (LLC)

You can either form your own company using our State Startup Guides, or we can do the work for you. If you order your LLC online, we process most orders within one business day.

3. Apply for business license(s), bank account & insurance

Each state has its own business licensing requirements, but the standard state license may be all you need. Check with your city, county, and state to find out how to get your business license. If you need help, our business license partner can do the research and provide the right forms for a reasonable fee. We also partner with trusted banking and insurance partners to help you find the best solutions and pricing.

4. Sign up for Amazon Seller Central

Once your company is formed, you can sign up as a business with Amazon Seller Central. Existing accounts can be updated to get paid as a business.

Start Selling Books on Amazon

We’ve covered the top 5 Amazon book FAQs and also shared tips and resources to help you start selling fast. If an Amazon LLC is right for your book business, we can form your company anywhere in the US. Choose from 3 comprehensive packages to save time, money, and headaches. Be sure to add the EIN option to your order to get a business tax ID number. For more information, check out our LLC guides or contact our friendly support team to get all the help you need.

This page may contain affiliate links, which means MyCompanyWorks may receive a commission if you make a purchase using these links.